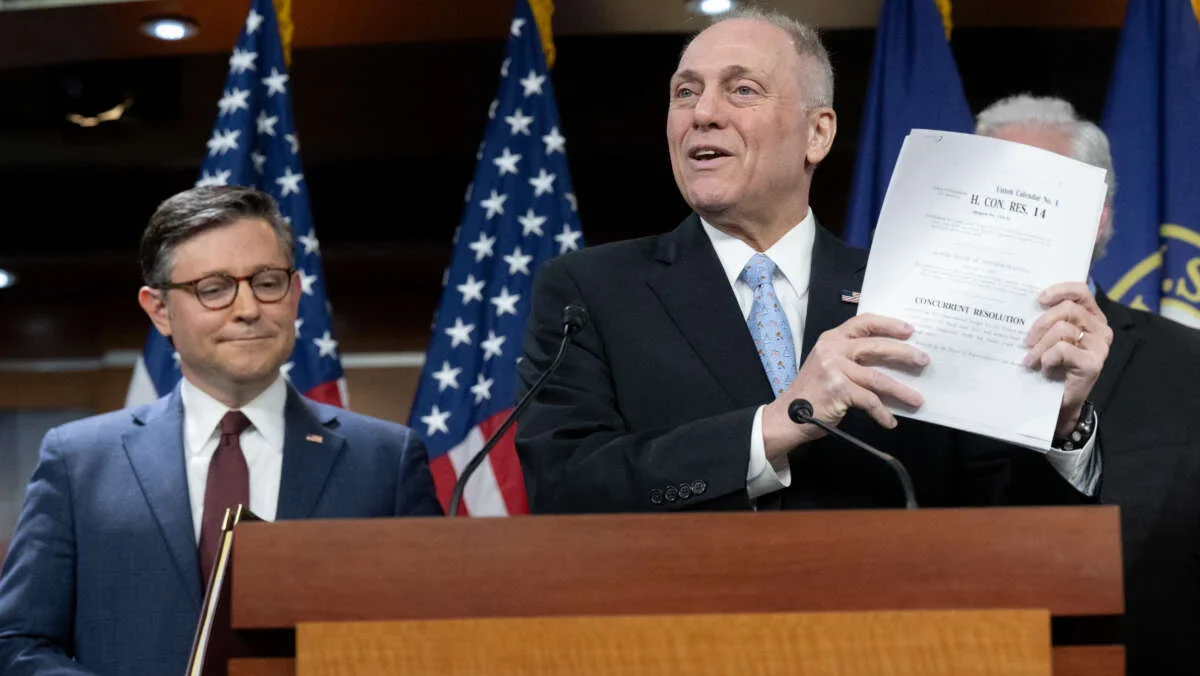

The Republican-led U.S. House of Representatives has introduced a comprehensive legislative package that proposes significant tax cuts and substantial reforms to Medicaid and other federal programs. Dubbed “THE ONE, BIG, BEAUTIFUL BILL,” the proposal aims to make permanent the tax reductions from the 2017 Tax Cuts and Jobs Act and implement new deductions and credits, while offsetting the costs through extensive spending cuts.

Key Tax Provisions

The proposed tax changes are estimated to cost at least $4.9 trillion over the next decade and include:

- Making permanent the lower income tax rates from the 2017 Tax Cuts and Jobs Act.

- Increasing the standard deduction by $1,000 to $1,500 until 2029.

- Expanding the Child Tax Credit to $2,500 through 2029, then maintaining it at $2,000, indexed to inflation.

- Exempting taxes on certain tipped incomes, such as those from hair care and spa services.

- Exempting taxes on overtime pay and interest payments on loans for domestically assembled cars.

- Allowing deductions up to $30,000 for state and local tax payments, up from the current $10,000 cap.

- Introducing a new $4,000 deduction for seniors.

- Permitting parents to contribute up to $5,000 tax-free annually to “MAGA Accounts” for their children’s future expenses.

- Raising taxes on large university endowments from 1.4% to 21%.

Notably, the plan does not include President Trump’s earlier suggestions to increase the top income tax rate for the highest earners or eliminate the “carried interest” tax break for investment managers.

Medicaid Reforms

To offset the tax cuts, the bill proposes $715 billion in savings from Medicaid over ten years. Key changes include:

- Requiring able-bodied adults without dependents to work, volunteer, or attend school for at least 80 hours per month to qualify for Medicaid.

- Enhancing verification processes to ensure eligibility of participants and healthcare providers.

- Excluding noncitizens from the program and penalizing states that use their own funds to provide coverage to undocumented immigrants.

- Blocking regulations that mandate minimum staffing levels at nursing homes and other long-term care facilities.

- Prohibiting funding for gender transition therapies for minors.

- Prohibiting payments to large providers like Planned Parenthood that specialize in reproductive health services.

- Limiting state taxes on providers used to raise the federal government’s contribution.

The Congressional Budget Office estimates that these changes could reduce Medicaid enrollment by at least 7.7 million people over the next decade.

Additional Provisions

The bill also includes measures to:

- Cancel funding for green-energy grants and other environmental initiatives.

- Increase defense spending, including funds for a new missile defense system.

- Allocate $69 billion toward intensified border security measures, including funding for mass deportations and construction of the border wall.

- Restructure student loan repayment plans and tax certain university endowments.

- Increase fossil fuel development on public lands by reducing royalties and expediting permits.

Political Landscape

The proposal has sparked significant debate within Congress and among the public. Democrats have criticized the bill for its deep cuts to social programs and potential to increase the national debt. Some Republicans, particularly those from high-tax states, have expressed concerns over the proposed cap on state and local tax deductions. House Speaker Mike Johnson aims to pass the legislation by Memorial Day, but internal disagreements and public protests may pose challenges to that timeline.

As the bill moves through the legislative process, its potential impact on millions of Americans’ healthcare coverage and financial well-being remains a central point of contention.

Source

This news article is based on information from

Dallasnews.com -“Republican tax and health plan: What it might mean for Americans”( May 13, 2025). Retrieved from:https://www.dallasnews.com/news/national/2025/05/12/republican-tax-and-health-plan-what-it-might-mean-for-americans/

You Might Also Like

Popular Categories

Popular News

Grapevine - Colleyville - Southlake

Trophy Club Town Council Approves $3.06 Million Capital Funding Transfer and Welcomes New Council Member Garry Ash May 29, 2025

Frisco

The Links on PGA Parkway in Frisco to House Nearly 2,000 Residents by 2027 May 29, 2025

Collin County News

🚧 Spring Creek Parkway Closure Set for June 2025 May 26, 2025

Flower Mound - Highland Village - Argyle

Flower Mound Council Approves Chapter 380 Agreement to Boost Furst Ranch Development May 26, 2025

Grapevine - Colleyville - Southlake

Colleyville Considers Doubling Homestead Exemption to 14% for 2025. May 23, 2025

Frisco

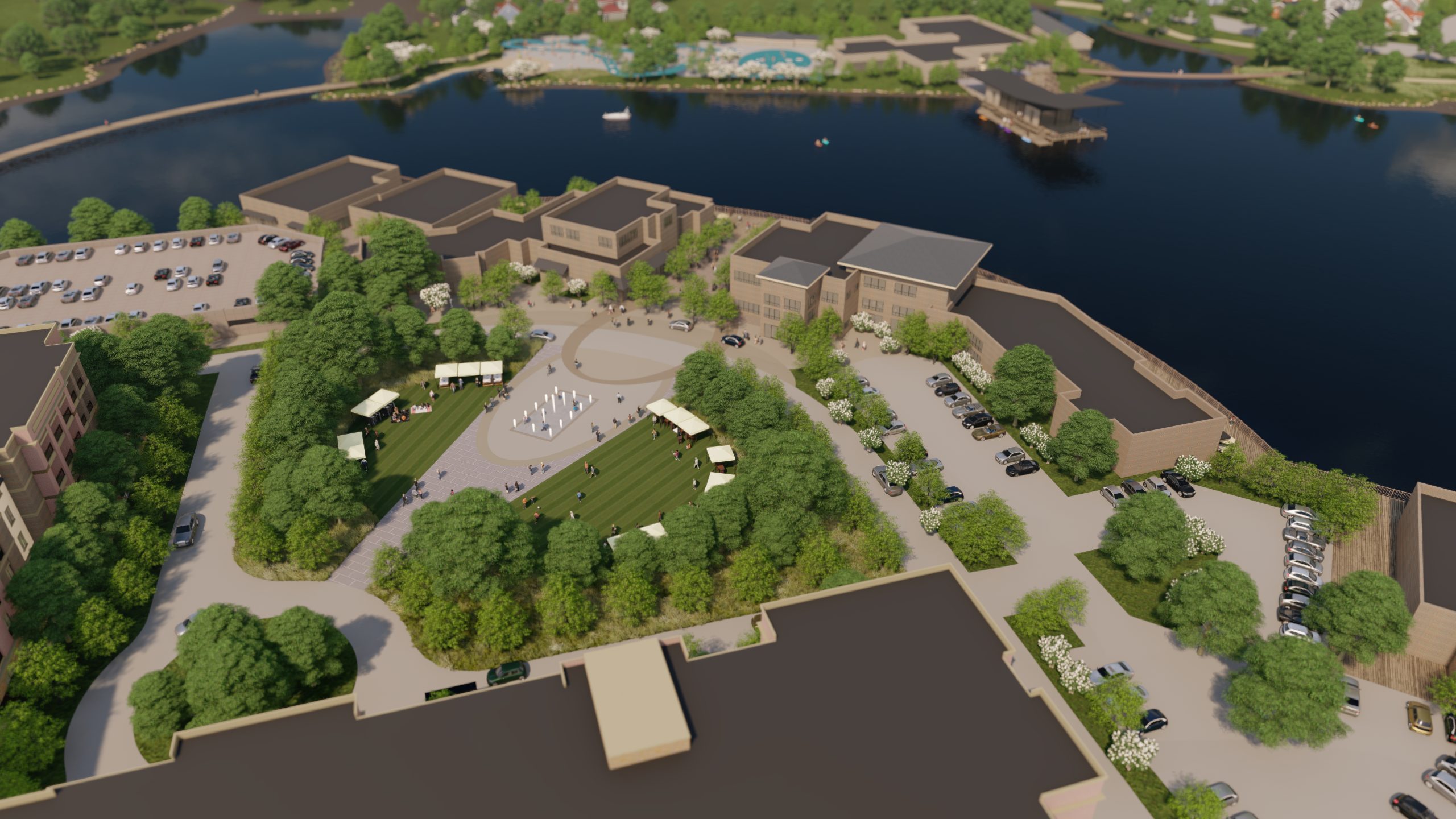

Frisco Approves $16M Parks Department Building and Nature Center May 23, 2025

Collin County News

Texas House Approves $10 Billion Property Tax Cut, Offering Relief to Homeowners and Businesses May 21, 2025

Collin County News

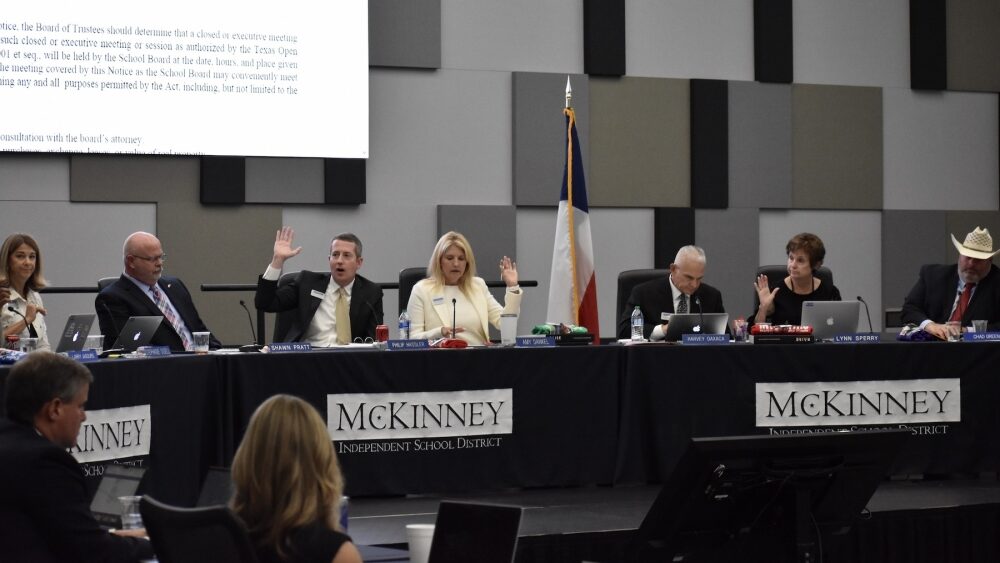

McKinney ISD Proposes Property Tax Rate Reduction Amid $7M Budget Shortfall for 2025–26 May 21, 2025