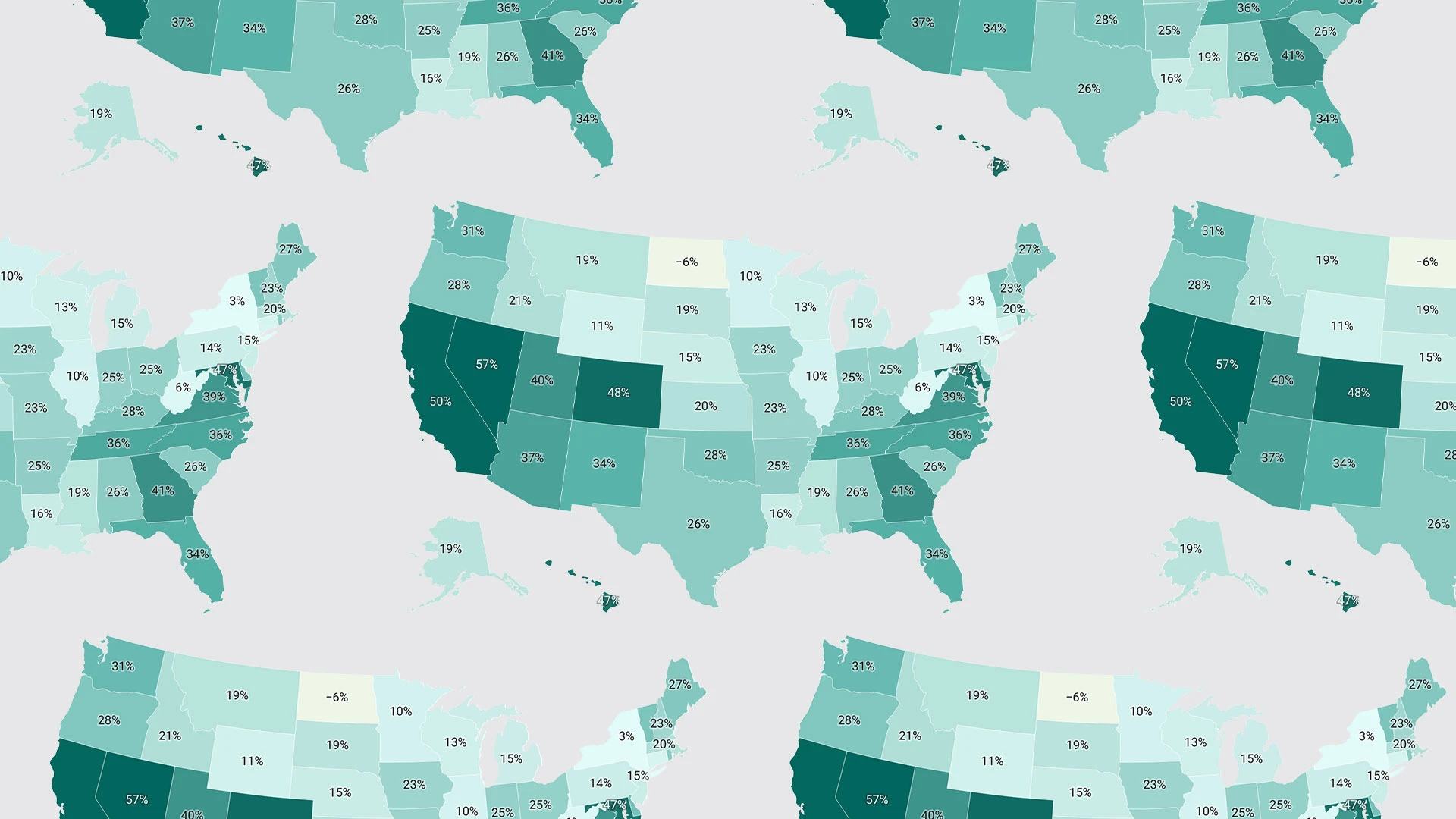

The cost of buying a home in the United States continues to climb, and the income needed to afford a median-priced property varies dramatically depending on where you live. A recent analysis of housing data reveals just how much income families need to qualify for a typical home in each state—and the gap between the most and least expensive states is staggering.

States Where Homeownership Requires the Highest Incomes

In several coastal and high-demand states, the price of entry into the housing market is steep. Here are a few standout examples:

- Hawaii: With a median home price around $800,000, families would need to earn about $235,588 annually to afford a home.

- Massachusetts: Buying a typical home priced at $732,450 would require an annual income of around $215,696.

- California: To afford a median-priced home of $715,000, households would need to earn approximately $210,557 per year.

These figures are based on estimated mortgage payments, assuming a 20% down payment and a 30-year fixed-rate loan.

States Where Homes Are Still Relatively Affordable

In contrast, there are states where homeownership is far more accessible, especially for families earning under $80,000 a year:

- West Virginia: With a median home price of $249,000, a family would need to earn around $73,327 annually.

- Ohio: Median home prices sit at about $252,500, requiring an income of $74,358.

- Michigan: A typical home costs $268,700, and the income needed is approximately $79,128.

These regions offer more affordable options, especially for first-time buyers or families looking to relocate for a lower cost of living.

National Picture: The Cost of Homeownership Keeps Rising

Across the U.S., the average household income required to afford a median-priced home has surged to roughly $116,986. That’s an increase of nearly 50% since 2020, driven by rising home prices and interest rates.

As homeownership becomes increasingly tied to location and income, understanding these state-by-state differences can help families plan smarter—whether they’re looking to buy locally or considering a move to a more affordable area.

source

This news article is based on information from:

realtor.com -“How Much You Need To Earn in Every State To Buy a Home” (January 20, 2025). Retrieved from:https://www.realtor.com/news/trends/how-much-earn-buy-home-state/

You Might Also Like

Popular Categories

Popular News

Collin County News

McKinney Planning & Zoning Commission Recommends Expansion of Aster Park with 300 New Homes June 13, 2025

Collin County News

Celina Approves $11.87 Million Phase 1 Contract for Wilson Creek Park June 13, 2025

Flower Mound - Highland Village - Argyle

Walmart Health & Wellness Expands Access to Care Across Texas, Including North Texas Communities June 11, 2025

Collin County News

Plano’s Asphalt Overlay Projects Resume, Signaling Continued Investment in Infrastructure June 11, 2025

Collin County News

Celina Greenlights 49 New Homes at The Parks at Wilson Creek June 9, 2025

Grapevine - Colleyville - Southlake

🚌 Carroll ISD Offers Discounted 2025–26 Bus Passes Through July 14 June 9, 2025

Collin County News

McKinney Approves Zoning for 785-Acre Billingsley Development, Paving Way for Major Growth June 6, 2025

Collin County News

Celina Plans 130 New Homes as Growth Continues Across North Texas June 4, 2025