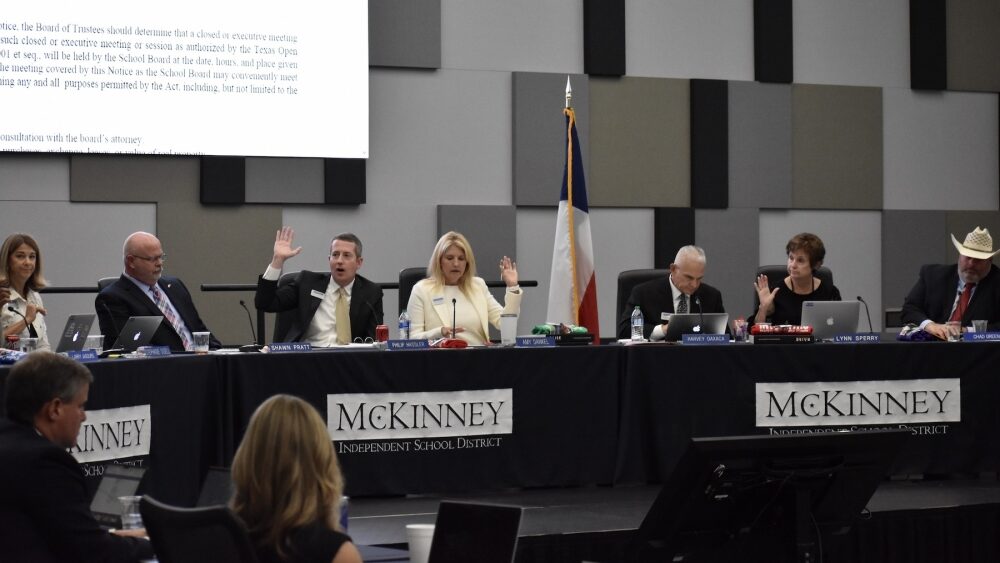

McKinney Independent School District (MISD) officials have proposed a property tax rate decrease for the 2025–26 school year, even as the district faces a projected budget shortfall of nearly $7 million.

At a May 12 board meeting, Chief Financial Officer Marlene Harbeson presented the proposed tax rate of $1.0780 per $100 of assessed property value, marking a decrease from the previous year’s rate of $1.1252. This rate comprises two components:

- Maintenance and Operations (M&O) Rate: Set at $0.7080, as determined by state law.

- Interest and Sinking (I&S) Rate: Set at $0.37, determined by district officials.

The proposed tax rate is based on projected property values from the Collin Central Appraisal District, which estimates a 10.75% increase from the prior year, bringing the total to $31.4 billion. Despite the rise in property values, the average single-family home value in McKinney has increased by approximately $6,000, reaching around $581,600 in 2025. Consequently, the owner of an average single-family home can expect their tax bill to decrease by $162.

However, the district anticipates a budget shortfall of nearly $7 million for the upcoming school year. Officials are currently exploring options to address this deficit while maintaining the proposed tax rate reduction.

Source

This news article is based on information from

Community Impact -“McKinney ISD officials project tax rate decrease, nearly $7M shortfall for 2025-26 school year” ( May 16, 2025). Retrieved from:https://communityimpact.com/dallas-fort-worth/mckinney/education/2025/05/16/mckinney-isd-officials-project-tax-rate-decrease-nearly-7m-shortfall-for-2025-26-school-year/

You Might Also Like

Popular Categories

Popular News

Collin County News

Richardson Residents and Officials Push Back Against Proposed DART Service Cuts July 14, 2025

Grapevine - Colleyville - Southlake

Tarrant County to Hold Special Election for Texas Senate District 9 as Keller Mayor Enters Race July 11, 2025

Frisco

Plans Advance for New Frisco Police Shooting Range and Training Facility July 10, 2025

Frisco

Frisco Approves New Commercial Development with Emphasis on Open Space July 7, 2025

Frisco

Jackson Road Bridge Reopens in Colleyville After 18 Months of Construction July 4, 2025

Uncategorized

July 4 Holiday Closures Announced for Flower Mound, Highland Village, and Argyle July 4, 2025

Frisco

Frisco Approves Maximum Homestead Exemption to Boost Property Tax Relief July 2, 2025

Collin County News

Over 315 Homes Sold in McKinney in May: Real Estate Snapshot July 2, 2025