In its May 2025 meeting, the Federal Reserve chose to keep interest rates unchanged, maintaining its cautious stance amid persistent inflation and mixed economic signals. While this decision may not bring immediate relief to borrowers, it carries important implications for the housing market and for Texas homeowners keeping a close eye on mortgage rates, property values, and long-term affordability.

What the Fed’s Decision Means

The Fed’s decision to pause rate hikes comes amid uncertainty in the economy, with inflation still above target levels but job growth and consumer spending showing signs of cooling. Many market watchers had hoped for a rate cut this spring, but the Fed made it clear: it needs more consistent signs of progress before taking that step.

How This Impacts the Housing Market

Mortgage rates remain elevated, with the average 30-year fixed rate hovering near 7%. This continues to cool the housing market, particularly for first-time buyers who are sensitive to monthly payment costs. However, steady rates could prevent further affordability erosion and may help stabilize home prices in Texas markets like Dallas-Fort Worth, Austin, and Houston.

What Texas Homeowners Should Watch For

With high mortgage rates keeping some buyers on the sidelines, home price growth may slow but don’t expect property tax relief just yet. Appraisal values, which are based on past sales, may still trend upward in certain counties. This makes it critical for homeowners to review their 2025 property valuations and consider a protest if the numbers don’t reflect the current market

While the Fed’s decision to hold rates steady offers a moment of stability, the road ahead remains uncertain. Texas homeowners should stay informed, monitor both mortgage trends and appraisal values, and be ready to take action if their property taxes don’t match market conditions. .

Source

This news article is based on information from

Realtor.com-“Fed Holds Interest Rates Steady After Trump Ripped Powell for Inaction”( June 18, 2025). Retrieved from:https://www.realtor.com/news/real-estate-news/fed-interest-rate-decision-may-2025/

You Might Also Like

Popular Categories

Popular News

Collin County News

Collin County Switches to Hand‑Marked Paper Ballots for November June 23, 2025

Grapevine - Colleyville - Southlake

Colleyville to Launch Sidewalk Projects on Bransford Road & Montclair Drive in August June 23, 2025

Collin County News

Home Insurance Providers Are Pulling Out of High-Risk States Is Texas Next? June 20, 2025

Frisco

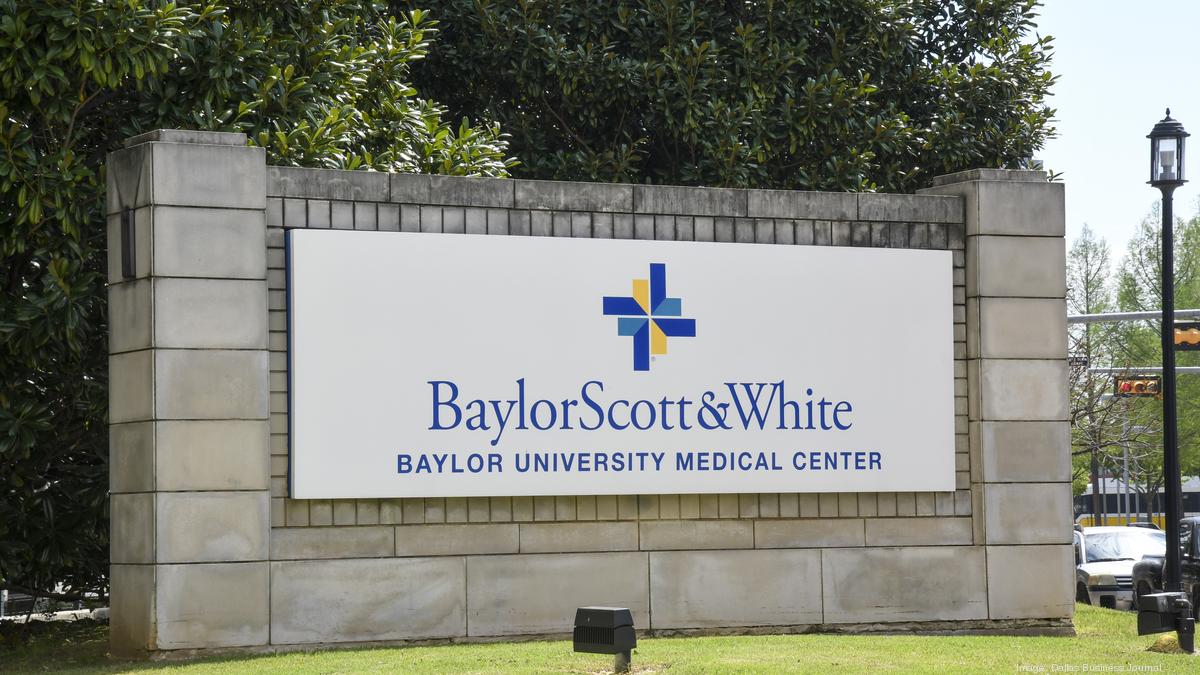

Baylor Scott & White Unveils $265M Frisco Medical Center Set to Open in 2026 June 18, 2025

Flower Mound - Highland Village - Argyle

Toll Brothers to Begin Sales at Argyle’s Enclave at Hickory Hill This Fall June 18, 2025

Collin County News

Plano ISD Approves Historic Teacher Pay Increases for 2025–26 June 16, 2025

Collin County News

Downtown McKinney’s Iconic Water Tower Undergoes $4.5M Restoration June 16, 2025

Collin County News

McKinney Planning & Zoning Commission Recommends Expansion of Aster Park with 300 New Homes June 13, 2025